This is part two of a four part article series in which we demonstrate how to identify value streams of using a virtual assistant to partially or fully automate “customer-to-business” interactions. We will detail how to measure quantifiable cost savings and track qualitative benefits in a contact center environment. You can read part one–which discusses misrouted calls–here.

In this article we will investigate the Identification & Verification (ID&V) value stream for virtual assistants. ID&V needs very little explanation as it’s prevalent in almost every call center voice interaction for any vertical. The process typically involves a caller giving a piece of identifying information–such as a phone, account, or ticket number–followed by several other pieces of information to verify the caller’s identity–such as the date of a recent bill payment, full name, address, etc.

Some contact centers have made advancements in terms of using Caller ID or Voice Biometrics to passively ID&V the caller. However, in most cases it can be both frustrating and costly, and often a misused transaction in the contact center. The reasons for this are 2 fold:

- Incorrect Application of ID&V: In many call centers, agents will start each call by identifying and verifying the caller before the caller expresses the reason for their call. This occurs either by habit or process, but in either case it causes a poor customer experience and takes up unnecessary agents minutes and therefore cost. A good example of some intents that should not require ID&V are:

- FAQs / How Tos

- Troubleshooting

- Pushes To Digital Channels

- Store / Location Assistance

- Documentation Requests

- Pro-active updates

- Excessively Long ID&V process: This issue is prevalent in contact centers where inbound callers are calling regarding “account specific” information. A few examples include Utilities, Airlines, Retail Banks, Insurance, and Teleco to name a few. Agents & call center managers, fearing fraud, force the caller through an extended line of questioning, usually adding a few additional questions as a risk factor, adding unnecessary agent minutes & cost.

Even in a highly optimized and efficient call center, ID&V can still prove a costly transaction for live agents. Let’s assume that the average call center with 1 million calls must ID&V 75% of their callers, with the process consisting of one identification question:

- May I have your account / loyalty / tracking / reference / policy number?

- Do you have a ticket or case number?

- Can you tell me your post code & first line of address?

Let’s also assume that agents must also verify the caller with at least 3 of the typical call center identity verification questions:

- What is your postcode?

- What is your full address

- What is your full name?

- What is your DOB / date of last payment / appointment date?

- What is your telephone pin / password?

- What is the make / model / number plate of your vehicle?

- How do you pay for your bills / when was your last bill / when is your next bill?

For an experienced agent, connected to a caller who has the answers to the questions readily available, each question typically takes 13 seconds for a question and answer or 52 seconds for the entire process. Note that this excludes time delays caused by “Chit Chat” / Un-Prepared Customers / Re-Prompting or Re-Phrasing of Questions / etc…

So if we put this all together we can quantify cost to the contact center based on the following information:

- 1 Million Calls with 75% requiring ID&V

- 52 Seconds ID&V process

- £0.25 Pence Agent Cost Per Minute

The quotient for ID&V results in a total of £162,500 gross cost savings if this task were to be removed from live agents.

PolyAI virtual assistants have a proven track record of automating Identification & Verification transaction types even for the difficult alphanumeric strings such as reference numbers, postcodes, and number plates.

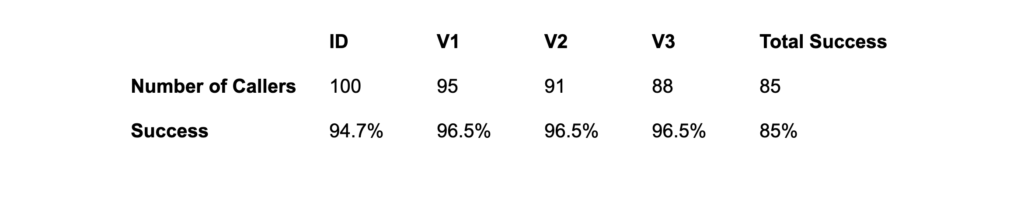

Recent benchmark testing has demonstrated the Virtual Assistant’s capability to achieve a 94.7% success rate when “collecting” information for identification from a customer, and 96.5% success rate when “matching” information against a customer record for verification. The following table illustrates the overall ID&V success at each stage of the process:

This means that in a 4 step ID&V process, taking into account the success at each stage the Virtual Agent can generate a gross savings of £138,125.

In the articles to come, we will continue to investigate Vertical Specific Self Service transactions, as well as qualitative value streams such as customer satisfaction, retainment, & effort.