What is PolyAI for insurance?

PolyAI handles high-volume insurance needs with the care and efficacy of a real person.

Listen to Pawel's health insurance question

How it works

Create and deploy a voice assistant that handles 50% or more of customer calls in as little as 6 weeks.

Eliminate wait times and abandoned calls.

A voice assistant that sounds like your best staff member and never misses a call.

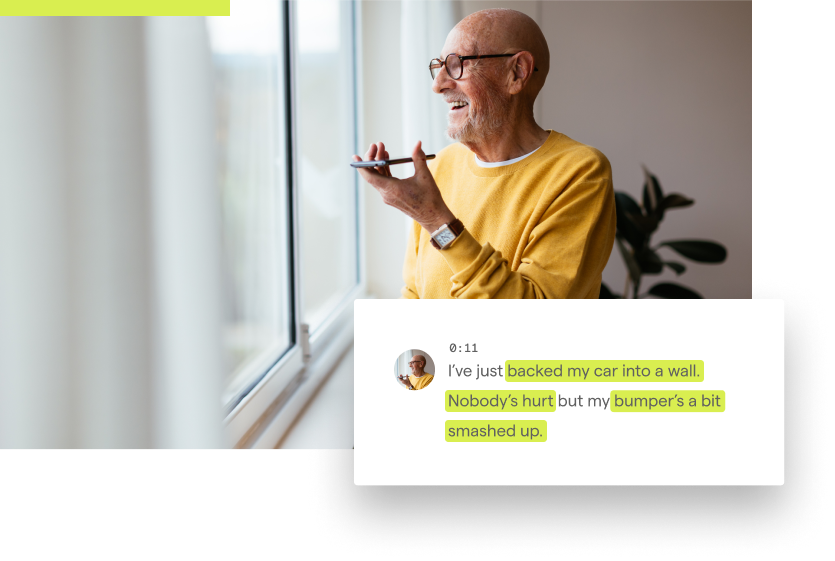

Delight customers with conversational claims.

Empower policyholders to make claims, payments and other account transactions through natural conversations, without waiting for an agent.

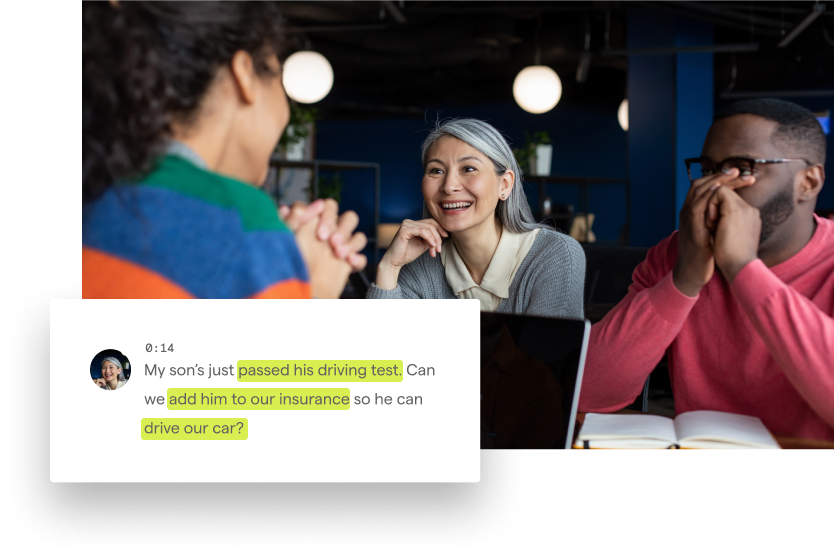

Free your staff for the customers who need them most.

Automate repetitive tasks with a voice assistant that sounds like a real person, and free up your agents to build lasting customer relationships.

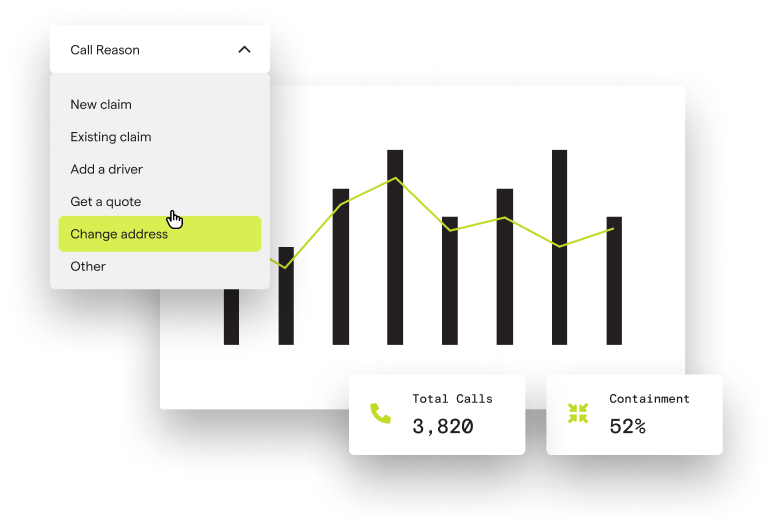

Unlock insights to improve policyholder experience.

Access new operational insights to drive improvements to policyholder experience.

The numbers speak for themselves.

reduction in call volume

CSAT score

languages spoken

calls answered, 24/7/365

“This is next-level conversational AI, and it’s far and away better than anything else I’ve heard in the market.”

Your trusted insurance partner.

Security

24/7 support with compliance certification to meet your needs including ISO 27001, SOC 2, PCI DSS, GDPR and more.

Integrations

No need to change your tech stack. Out-of-the-box and custom integrations make implementation safe and easy.

Data and Insights

Real-time insights. No data gaps, manual compiling, or business decisions based on guesswork.